CU Current Account

Finally, a real choice! Credit Unions bringing you a current account with a debit card and full overdraft.

HSSCU’s Current Account supports Apple Pay and Google Pay!

Introducing HSSCU's Current Account

- HSSCU members can apply for our current account instantly in their CUonline+ account.

- Should you not yet be a member, you can apply for HSSCU membership online and apply for your current account once joined.

- HSSCU offers Apple Pay and Google Pay. All information/FAQs on these services can be found here: Apple Pay | Google Pay

- All FAQs on the Current Account service as a whole can be found here

To use this service, your account will have to have an up-to-date photo ID (Passport or Driving Licence) & proof of address (bank statement or utility bill, dated within 6 months of your current account application).

Login & Apply Now Register Then ApplyWhy Use Our Current Account?

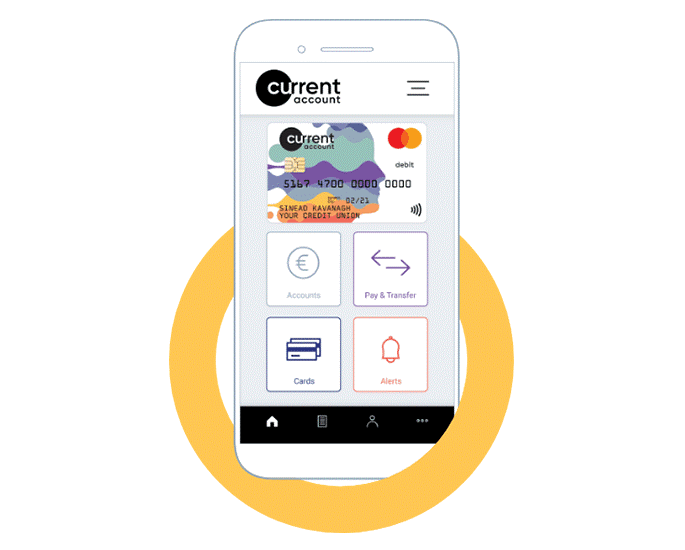

You will have instant access to your money through our Mastercard® Debit Card, secure app, online portal, and mobile functionality. HSSCU’s current account enables you to tap your card, use Apple Pay & Google Pay, pay your bills, withdraw cash and pay at point of sale; at millions of locations worldwide.

Our credit union current account combines the member-first, trustworthy nature of Irish credit unions with the technological enhancement of a progressive financial institution. Added to our low and transparent fees (see brochure below), you can see why this is the correct choice for your current account needs. Once you open a current account with HSSCU it’s also easy to switch! Our Current Account Switcher Form is here.

Current Account Switcher Pack Contact Us for More InfoCurrent Account Features

- Easy Sign-Up

- Debit Card (Mastercard®) - Globally Accepted

- Apple Pay & Google Pay

- Overdraft (Up to €5,000, subject to approval)

- Secure Online Shopping & Contactless Payments

- Pay Your Wages Into Current Account

- Set Up & Manage Standing Orders & Direct Debits

- Full Control with Mobile App, eStatements & eFee Advices

- Transfer Funds Between Accounts

- Benefit from Mastercard Priceless (visit www.priceless.com)

- Cashback Available

3 Steps to Applying for a Current Account

If not yet a member, join us online

You can register for CUOnline+ on our website

Login to your online account and apply right now

Important Information

- To be eligible for a current account, debit card, or overdraft, you must be a member of HSSCU and resident in the Republic of Ireland.

- To be eligible for an overdraft you must be over the age of 18. Lending criteria, terms and conditions apply.

- The maximum issuable overdraft amount is €5,000 (subject to approval).

- If your card is damaged, lost or stolen call Credit Union Card Services on 01 693 3333. The Customer Services line is open 24 hours a day, 7 days a week. Calls are charged at your standard network rate. Calls from mobiles may be higher. New cards will be issued on requests within 7 – 10 working days.

- You can learn more about Current Account’s Google Pay here

- You can learn more about Current Account’s Apple Pay here

- Worried about potential fraud with your current account? Visit www.fraudsmart.ie to stay informed and view our fraud brochure here.

- Strong Customer Authentication – Online Shopping: here

- Current Account FAQs: here

- Digital Wallet Terms & Conditions: here

- Currency Conversion Tool: here

- Current Account Fraud Awareness Brochure: here

- Mastercard and Priceless are registered trademarks, and the circles design is a trademark of Mastercard International Incorporated. This card is issued by Transact Payments Malta Limited pursuant to licence by Mastercard International. Transact Payments Malta Limited is duly authorised and regulated by the Malta Financial Services Authority as a Financial Institution under the Financial Institution Act 1994. Registration number C 91879. Credit unions are regulated by the Central Bank of Ireland.

CU Current Account FAQ

- Who Can Apply for a Current Account?

- Can I Use My Debit Card Abroad?

- Can I Change My Card's PIN?

- Can I Get Cashback With My HSSCU Debit Card?

- How Do I Get a Replacement Card?